Tax law stipulates that a minimum payment must be withdrawn from your RRIF each year and reported as income.

#Financial calculators dinkytown full#

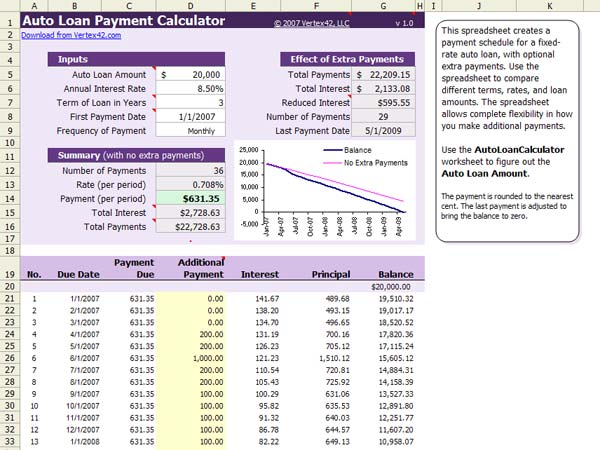

The latest you are allowed to take your first payment is December 31 st in the year you turn 72, however, the payment must be at least the full annual minimum* amount. Press the 'View Report' button to see a complete amortization schedule, either by month or by year. Change your monthly payment, loan amount, interest rate or term. Although this will vary by business and industry, a number above two may indicate a poor use of capital. Use this calculator to look at a variety of possible loans. A general rule of thumb is to have a current ratio of 2.0. Your current ratio helps you determine if you have enough working capital to meet your short term financial obligations. It is mandatory that you convert all your RRSPs by December 31 st in the year you turn 71. Formula: Current Assets divided by current liabilities. Amounts paid out of a RRIF are taxable on receipt.

Use this calculator to determine your allowable 72T. The property under a RRIF is created from a transfer of funds from an RRSP or another RRIF. Financial Calculators The IRS Rule 72T allows for penalty free, early withdrawals from retirement accounts. Click on the 'View Report' button to see a detailed schedule of your CDs balance and interest earned.

Just enter a few pieces of information and we will calculate your annual percentage yield (APY) and ending balance. A Registered Retirement Income Fund (RRIF) is a plan designed to provide Canadians with a constant income flow through retirement. Use this calculator to find out how much interest you can earn on a Certificate of Deposit (CD).

0 kommentar(er)

0 kommentar(er)